Author: Marguerite Behringer, E9 Insight

Grid Forward, EPRI, SEPA, and GridWise cohosted the first Utility Business Model Working Group meeting of 2022 in late February with a focus on “Selling Energy As-A-Service.” Consultants and utility representatives explored examples of Energy As-A-Service (EaaS) and how EaaS has emerged as an advantageous business model, particularly when integrated with distributed energy resources (DERs). EaaS can lead to reduced utility bills, harmonized customer devices, reduced emissions, and provide new revenue streams.

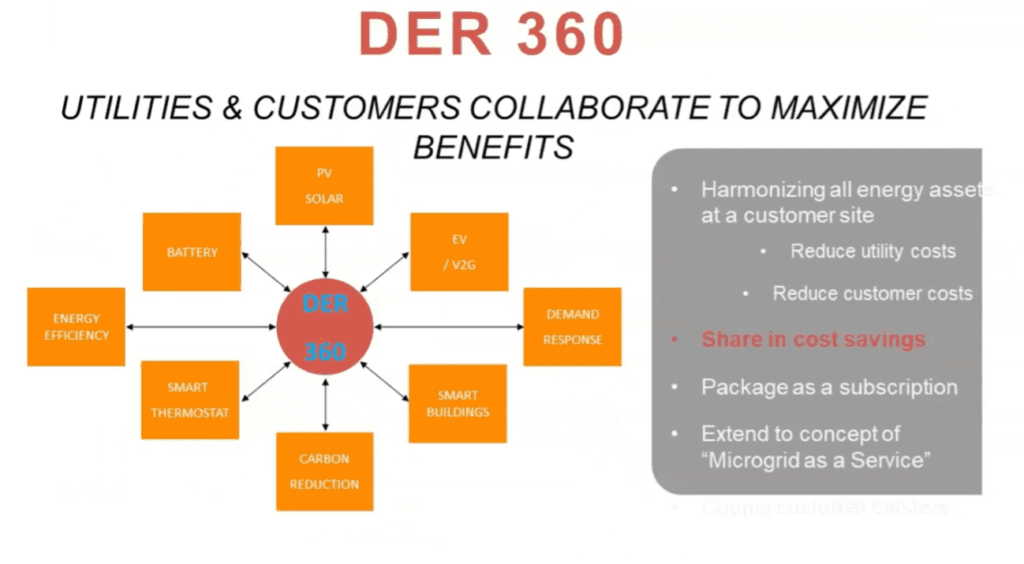

Sanem Sergici, Brattle Group introduced the audience to the EaaS business model, explaining that an “energy services utility” provides expanded integrated energy services using a customer-centric model. This model allows utilities to interact with behind-the-meter resources and provide new products and services. Typically, utilities shift away from selling kWhs to selling packages or use cases, such as heating, light, 200 EV charging sessions, etc. Sanem emphasized that all controllable customer end-uses are candidates for EaaS. Current regulatory treatment of DER assets poses complications for the EaaS model, as most utilities are prohibited from owning behind-the-meter assets. Some existing, approved programs permit utility ownership under certain conditions, such as pilots in New York that permit storage ownership if the program serves underserved markets or accelerates technology development.

Other successful examples of EaaS are in motion within Exelon/PHI’s Utility of the Future framework. Steve Sunderhauf shared that Exelon/PHI is experimenting with four business models and discussed two EaaS examples. Pepco Maryland is managing an electric bus depot project which allows the utility to operate a third-party owned 1 MW/3MWh battery at a public bus station. The project avoided new feeder lines and serves as a local microgrid. In Delaware, Delmarva Power is running a virtual power plant project on the isolated peninsula of Elk Neck, a residential community located on the Chesapeake Bay. This project aggregates behind-the-meter batteries for grid use, provides distribution services, peak shaving, and more. A separate pilot within this program is testing the participation of these resources in the PJM market.

Andrew Dillon, West Monroe Partners, reviewed trends in EaaS, including the rise of EV charging subscription services. Andrew emphasized that customers have a growing number of grid assets, and those assets are becoming smarter. This trend has resulted in an increasingly complex energy ecosystem for customers. Subscription and package services managed by the utility allow customers to manage their devices harmoniously and efficiently.

Additional innovative examples from Green Mountain Power were shared by Graham Turk. Turk reviewed the role of storage in Vermont and noted that Vermont is third in the U.S. for total installed solar capacity as a percentage of peak load, following Hawaii and California. Green Mountain Power’s EaaS offers customers to lease Telsa Powerwall batteries at $15/month, while Green Mountain Power retains ownership of the battery for ten years. The program is considered a form of resiliency as a service, especially useful due to wildfire and storm issues in the area. In 2020 alone, the program resulted in an estimated $1 million saved through 13 MW of curtailed load.

Following the presentation, panelists and audience members discussed the need for careful design of EaaS programs to ensure that low-income customers and non-participating customers do not bare undue costs. Panelists agreed that EaaS packages and rates should be kept simple to enhance customer engagement. Despite the clear benefits of utility management (streamlined communication, grid management, better information, etc.), regulatory questions related to competition and asset recovery remain, complicated further by the novelty of distributed storage assets.