The Grid Forward organization was formerly launched in June of 2019, but our roots go back to 2010, when a group of forward-looking energy and tech experts banded around the name “Smart Grid Oregon.” Now we look forward to our first full year as Grid Forward, and the amazing promise of grid modernization in the decade about to begin. We asked some of our influential friends what they made of industry progress over the last decade, and to help us polish the crystal ball and view what the next 10 years will bring to our industry and our region.

Our group of experts reflects the range of stakeholders that are helping Grid Forward accelerate grid innovation: utilities, regulators, consultants, tech providers, and investors. And to help us kick off this exercise, we found some grid technology predictions from 2010 (see below). Let’s hop in the time machine!

2010: Key Roles in Launching a Smarter Grid

Looking back to 2010, the U.S. was starting to come out of the great recession and the federal government was spending big on energy and the grid. Leaders from BPA, Portland General Electric, PNNL and others saw an opportunity to coordinate emerging energy advancements building on new concepts in smart grids, including via the regional Smart Grid Demo Project. Components from transactive energy and various advanced grid controls were tested in this flagship effort and along side it our organization took its roots to support smart grid industry development and the installation of advanced grid infrastructure assets.

We asked influencer group what they were doing around this same time, a decade ago:

Jeff Ackermann, Chairman, Colorado PUC – I was heading up an internal policy research group at the CO PUC, supporting the commissioners’ interests with a small staff of researchers. We were exploring such topics as: data privacy (and smart meters), the EIM concept, best practices in resource planning, the use of scenario planning to improve resource planning decision making.

Larry Bekkedahl, VP Grid Architecture, Integration & Systems Operations, Portland General Electric – In 2010, I was working for the Bonneville Power Administration. We had just been awarded the AARA funds from the U.S. Department of Energy for the Western Interconnection Syncrophaser Project, or WISP. And, we were building out the 500kV transmission system to accommodate 7,000MW of wind generation being built in the Northwest.

Patricia Bourne, CEO, EQUS – I was working for a distribution power co-operative in Alberta. Changes in Alberta were happening as conversations became more frequent regarding renewable energy. Deregulation had occurred 10 years earlier and after 10 years we had stable electricity prices. However, distributed generation started to gain traction and we started to consideration different options for generating our own electricity. AMI was also discussed and looked at by the GoA to make it mandatory but nothing came of it because of the connectivity issues in rural areas.

Cassie Bowe, Vice President, Energy Impact Partners – I was working on net metering policy at SunPower.

Colton Ching, senior vice president of planning and technology, HECO – We were working on our own ARRA stimulus projects, automating parts of our sub transmission system to increase utilization and flexibility of the grid. What we should have spent more time focusing on was the wave of rooftop solar systems that were to hit us in the 2010s where we went from less than 1,000 rooftop systems to over 80,000 systems today and how our grids needed to evolve to be ready for its new and different roles.

Scott Corwin, Exec. Dir., NWPPA – In 2010, I was working with the Public Power Council. Those were interesting times in the wholesale power and transmission realm. We were starting to see a lot more discussion about the need for flexibility and capacity, more pervasive adoption of new technology, and there was the first big move within WECC for an energy imbalance market. But, you also saw increased concern around the rising costs of transmission and power within the BPA portfolio.

Marissa Hummon, CTO, Utilidata – I was working at the National Renewable Energy Laboratory in 2010 and we were darn proud of having just answered the big question of the previous decade: Can the grid handle 20% wind energy? (Answer: yes!) We would laugh at that question today, but in 2010 there were many (perceived) technical barriers to a deeply decarbonized electricity grid. We dispelled myths about cycling conventional generation, the need to carry operating reserves equal to the online renewable generation capacity, and the efficacy of storage technologies providing energy and ancillary services. We developed methods for calculating the economic value of new generation technologies and made great strides in valuing demand-side participation in the market.

Carl Imhoff manages the Electric Infrastructure market sector at PNNL –The Pacific Northwest Smart Grid Demo was emerging; PNNL was leading that effort with 11 Northwest partners and multiple vendors to deliver the nation’s largest and most aggressive demo (I was also supporting AEP on the nation’s second largest demo). I was also leading the effort to deliver a national network of PMUs that would transform system observability, and doing the DIET scalable massively parallel grid tool runs that opened the way for open platform utility access to HPC.

Travis Kavulla, Vice President, Regulatory Affairs, NRG – In 2010, I had moved back to my home state, Montana, the previous summer and was putting together notes based on my previous two years. (I’d spent them split between grad school in Cambridge, England, and freelance journalism in Nairobi, Kenya.) That book did not come to pass—because I got pulled into the vortex of local politics. The details hardly matter. Suffice it to say that it was a “the emperor has no clothes” situation and I was among the very few offering that perspective. 2010 was the year of the “Tea Party” and I rode that wave as a Republican into elected office in Montana’s Public Service Commission. I was 26 years old. I spent the remaining months of the year reading Alfred Kahn’s The Economics of Regulation: really, my introduction to utility regulation.

Nancy Pfund, Managing Partner, DBL Partners – In 2010, we had just spun out of JPMorgan to create DBL and we were getting ready to raise our second fund. We were deep into our clean energy and sustainability practice, having sold Powerlight to Sunpower in 2007 and, after a long and sometimes tortuous road, celebrating the Tesla IPO. Rooftop solar was growing rapidly and we worked with our portfolio company SolarCity and others in the industry to create a policy framework that would support this growth. It was a busy time!

Jenny Potter, Commissioner, Hawaii PUC – I was working for Sacramento Municipal Utility District (SMUD), where I joined the SmartSacramento Division to assist with implementing a SmartGrid, funded by DOE’s ARRA Grant. I was responsible for the TOU/CPP pricing study, using AMI meter data to develop rates, reprogram meters to interval reads, and collect and bill customers on TOU and CPP rates. It was a wild success!

Mischa Steiner, CEO, Awesense – Starting Awesense! Basically, at that time I was certain that climate change would be a major issue. I saw two large offenders, which were CO2 (energy) and Methane (agriculture). Knowing nothing about Ag, I focused my efforts on something that I was confident that I could tackle with data and systems thinking.

Bold Predictions in 2010 – How Accurate Were They?

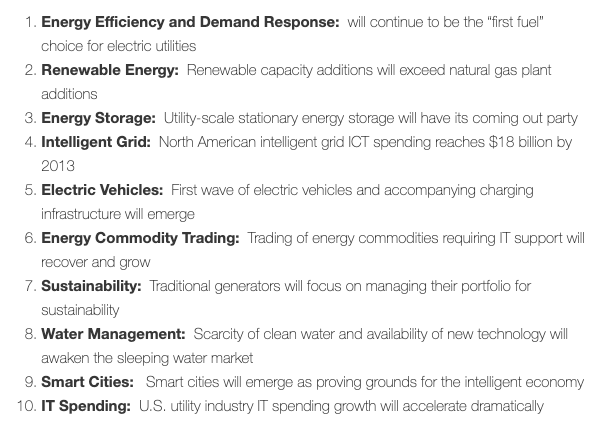

In January of 2010, as all these smart grid activities were going on, experts at IDC held a webinar called “Top Ten Predictions for the North American Utilities Industry” which was summarized in an article by Bill Chamberlin. “During the call the analysts reviewed the important driving forces impacting technology investment within the Utilities Industry for 2010.” Looking back, our experts have varied responses to how the predictions have played out. See if you agree.

Corwin – Clearly, on the larger scale, a lot of that work for better and faster information in grid management proceeded very well. There is a lot more information coming in a lot faster, more visibility, and that has opened a lot of potential for efficiencies. Some of the other elements associated with the predictions back then, like more storage at the home retail level, have lagged but are making strides more recently.

Pfund – Of course, one thing that we all missed over the last decade was the role of the grid in increased wildfire risk.

Potter – I agree with all of them, except number 4 and number 8. For the other eight, I am impressed at the foresight of the analysts!

Kavulla – A mixed bag! EVs are here, IT spending is rocketing, and storage’s having its “coming out party” is probably the right way to describe the state of maturation in that sector. But natural gas of course has absolutely dominated the power sector in the last decade, and while the word count on renewables and even storage has exceeded the ink spilled on natural gas, the reality is that natural gas has had a boom of the decade in the United States. Even well into the next decade that may persist.

Prediction 1 – Energy Efficiency and Demand Response will continue to be the “first fuel” choice for electric utilities

Bekkedahl – Energy efficiency has continued to be a great resource for capacity reduction or “first fuel,” with more than 40 years of great work going into it since the Hood River project. However, within this, Demand Response has not come online as quickly as I think many in the industry anticipated due in large part to technical challenges.

Imhoff – Energy efficiency proved successful as fuel of first choice. DR plateaued for the most part as market signals lagged in many jurisdictions such as the Pacific NW.

Prediction 2 – Renewable energy capacity additions will exceed natural gas plant additions

Ackerman – This one and #3 below saw the most progress. Market forces, at the wholesale level in particular, caused a capital migration from coal, through natural gas and into renewables (and even renewables plus storage, at the end of the decade).

Bekkedahl – Gas plant additions in the Northwest are on a downturn. Renewables are rightly being added, but not fast enough. Add to that an interesting dynamic where renewable energy prices continue to fall due to the breakneck pace of technological advancements, while regulation and pricing models lag behind. Solar generation in California and the resulting “duck curve” have also significantly impacted the entire west coast.

Bowe – The installed cost of solar has fallen farther than anyone predicted across the board. This has led to very competitive pricing, even when bundled with storage, but also low margins for players across the solar installation ecosystem.

Pfund – It’s incredible to look back at this list and see that several of these trends came true, and even further than expected! Some of the predictions on this list that I would describe as coming true in a big way are the rise of EVs and renewable generation outpacing natural gas. The importance of IT in energy trading is another one, although that is a trend that is still in its early days of taking off as it relates to renewables.

Prediction 3 – Utility-scale stationary energy storage will have its coming out party

Bowe – True, but at the beginning of the decade we would have predicted more GWs of stationary storage to have been installed across all sectors by 2020.

Ching – The prediction that runs true for us is the competitiveness of battery storage system for electric grid use. We’ve committed to very large levels of grid scale storage (2nd in the industry even though we’re a small utility) and distributed storage. Without the unique properties of storage – very fast response, zero-min regulation capabilities, and load shifting – we would not be able to move as fast in the adoption of renewable energy while maintaining reliability of our small isolated electric systems.

Pfund – Over the last few years storage has been way more dominant than the prediction around energy efficiency and demand response (prediction #1) as utilities bring online more renewable assets and use storage to make this more doable and cost-effective. While both are tools that enhance power system flexibility by better aligning variable renewable energy supply with electricity demand patterns, storage has become increasingly important in shifting the timing of supply and has really taken off in the past few years. Last year storage deployment grew almost 150 percent and reached over 6 gigawatt hours!

Prediction 4 – North American intelligent grid ICT spending reaches $18 billion by 2013

Potter – I don’t think we saw the ICT market proliferate by 2013.

Prediction 5 – The first wave of electric vehicles and accompanying charging infrastructure will emerge

Bekkedahl – The first wave of electric vehicles has landed. “Range anxiety” is a new concept experienced by early adopter consumers, while auto manufacturers have been slower to introduce EV options than expected. Tesla is a leader in the transportation electrification space, making significant advancements by focusing on available battery technology and investments in high-quality EVs. Overall, as we approach the new decade 40 new models will be released – an encouraging sign of what’s to come and that the future truly is electric.

Prediction 6 – Trading of energy commodities requiring IT support will recover and grow

Bekkedahl – The last decade brought us the Energy Imbalance Market, with the majority of Northwest utilities currently on board. This is huge for the energy industry. Generation is now dispatched from Folsom, California in real time all over the West every five and 15 minutes because of IT support. In addition, traditional generators are being used as part of the EIM and are metered separately, monitored with sensors and operationally optimized.

Prediction 7 – Traditional generators will focus on managing their portfolio for sustainability

Prediction 8 – Scarcity of clean water and availability of new technology will awaken the sleeping water management market

Bekkedahl – The water management market remains more or less the same. Although hydro resources are a continued source of green, clean energy, there are ecosystem and climate change impacts that the market faces and will continue to face in the decade ahead.

Pfund – One prediction on this list that fell short over the last decade is the water management market really taking off. Unfortunately we haven’t seen the same growth and rate of market adoption for clean water and water management technologies as we have for clean energy.

Potter – I also don’t think that we have had a shortage of clean water quite yet, but that is just a matter of time.

Prediction 9 – Smart cities will emerge as proving grounds for the intelligent economy

Ackerman – This one (and #7 above) are falling short. The “smart cities” (and corresponding “intelligent economy”) phenomena are still fledgling. This is likely due more to constraints on market access, rather than the emergence of the technology and related entities ready/willing/able to take a risk on delivering new services. Especially at the residential level, the emerging services require relatively easy access to the mass/center of this segment and/or to leverage sizable value propositions that will motivate end users to navigate the gauntlet with the emerging provider. Many states (such as my state) don’t have rates that provide that motivation; thus, market barrier-busting may be left to the commercial class.

Bekkedahl – Smart Cities have emerged with momentum driven by climate change policies and decarbonization efforts. Many cities and municipalities have implemented bold 100% clean energy future resolutions in response to climate change.

Ching – The prediction that has fallen a bit short, is one of smart cities. We continue to have hopes that convergence of communications and operation across multiple utilities and societal functions is part of our future. It just hasn’t happened as fast as we had hoped. And I think its speed is driven more by regulation, existing laws, multiple owners, multiple standards of control of systems and not due to a limit of technology.

Prediction 10 – U.S. utility industry IT spending growth will accelerate dramatically

Bekkedahl – Cybersecurity and the rising risks associated with potential grid attacks have led more and more utilities to significantly increase IT spending. Cloud computing and affordable storage options have significantly advanced computing power and analytical capabilities as well.

Are you ready to tackle predictions for the next decade? Watch for the next article in this series, “GridMod 2020 Part 2: Looking Ahead to Next Decade of Grid Modernization, Empowered by Awareness, Analytics and AI”