There’s nothing like being on the floor of our industry’s biggest show to get a feel for what’s on people’s minds. If you didn’t attend DistribuTECH, or were too busy to get around, read this interview with Smart Grid Northwest’s delegates, Bryce Yonker and Lois Gordon. In talking to over a hundred utility and vendor representatives, they heard alot about culture change, analytics, DERMS and resource platforms–but not so much about decarbonization or C&I work. Read their impressions below—it’s almost as good as being in New Orleans.

David: Why did you go? What did you want to accomplish at DistribuTECH?

Bryce: This year, like most years I go to DistribuTECH to get a sense of what’s going on in the industry. If you want to know what technology companies are doing, if you want to know what utilities are doing that’s interesting, DistribuTECH is the largest event to get a sense for that. I got a chance to chat with all of the major tech companies, and some growth stage ones. I met folks that are beyond our traditional geography, and learn about technology that they are thinking about and working on.

Bryce: This year, like most years I go to DistribuTECH to get a sense of what’s going on in the industry. If you want to know what technology companies are doing, if you want to know what utilities are doing that’s interesting, DistribuTECH is the largest event to get a sense for that. I got a chance to chat with all of the major tech companies, and some growth stage ones. I met folks that are beyond our traditional geography, and learn about technology that they are thinking about and working on.

Lois: I wanted to get a feel for the timing of grid modernization efforts. I tend to be an optimist in terms of what I want to see happen in the grid mod, and how that is going to change the customer experience. But as CEO of ASWB Engineering, I often find I need hold back on the technology at the leading edge that, for the most part, is not ready. So, I wanted to be in an environment to gauge how fast the industry is progressing, how it is progressing, and where is it really happening.

David: What would you say were the top two or three things you learned, whether new ideas, approaches, or technologies?

Lois: I definitely got the feeling that the leading utilities are not just moving forward with advanced metering infrastructure, they’re also moving forward with looking at their internal ways of doing things, their internal culture, how to break down the historical silos. It’s still very early, and no one leader is zooming ahead. Southern California Edison certainly came up as somebody with a clear plan that they’re executing on. I worked very closely with them, so I know a bit about that particular plan.

In terms of technology, I found an interesting range of very small companies working on similar things as very large companies like GE. For example, some are working on platform-like offerings that tie together all of distributed energy resources in a building with a dashboard, and ultimately looking for how they might interact in a transactive energy marketplace. It’s all pretty nascent still.

I also had conversation around open ADR, and some of the work other companies are doing. They struggle in terms of what’s really moving, where is it moving, and who’s going to be here three years from now. It puts us all in the same spot as our utilities partners. If we, as evangelists pushing on that grid modernization edge, cannot predict who’s going to be here in three years, it’s got to be exponentially more difficult for utilities.

Bryce: At DTECH, I’m focused on building relationships. Thinking about my discussions, I see three categories where there’s some movement.

The first one would be around analytics. The instrumentation going into energy systems to provide deeper levels of visibility has really accelerated in recent years. It’s not just AMI—the amount of metering, sensoring and monitoring equipment is becoming much more pervasive. Providers are starting to wrestle with, “What am I going to do with this huge stream of information that I now have access to? How can I make actionable insights?” There are good use cases in which people have helped operators leverage deep data sets for actionable information, such as outage management—whether or not infrastructure was intended for that outcome.

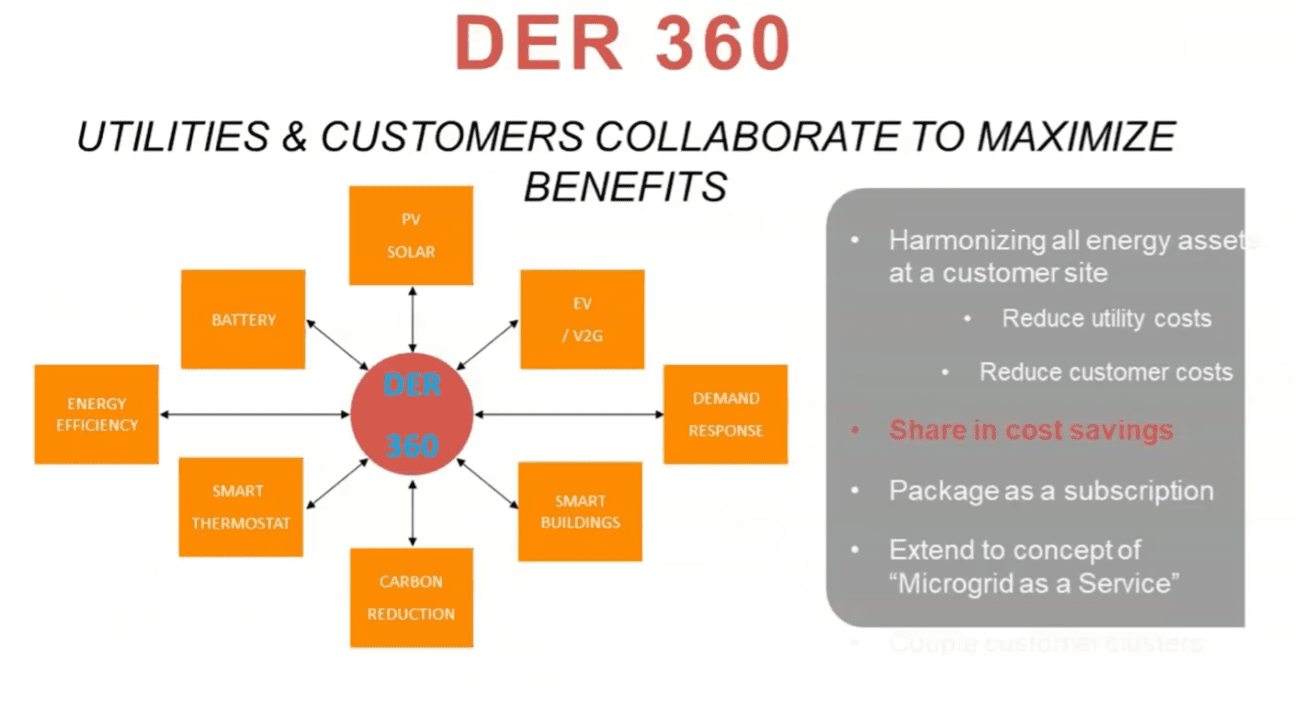

That leads to my second category, DERMS. If you ask an operator in earnest about how their experiences are going, they will still tell you that it’s a work in progress. It seems that growth stage providers have more contracts and traction. But it’s still somewhat unclear how the Holy Grail ingestion engine of all things distributed comes about and is effectively controlled. If you’re looking for or a storage management platform, or a demand-side thermostat or hot water platform, or a better visibility on distributed solar, many platforms are doing a good job as a single-use resource. But, bringing all of the different parts into one is still a bit of an open space.

It’s still somewhat unclear how the Holy Grail ingestion engine of all things distributed comes about and is effectively controlled.”

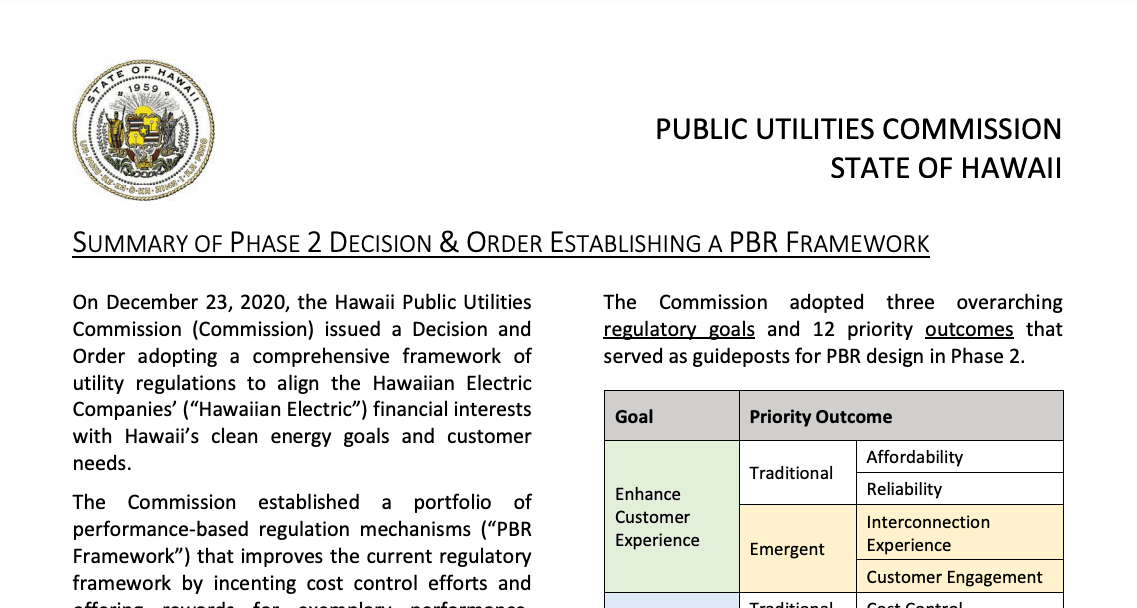

The third category that I’m hearing a lot about—and I’m rather optimistic that it continues to progress—is the new role of energy utilities and electric grid operators as a platform resource for the marketplace. In almost jurisdictions utilities are still making rate-based capital expenditures, and their business model essentially allows them to sell kilowatt hours. It will be interesting to see how they become platform providers of energy services in the future.

Utility business models have a lot of disincentives for many of the technologies that people are trying to sell to them. But if regulatory progress allows them to operate as platform providers, they can scale and adopt all these new technologies at a much faster clip than they have been incentivized to do so yet. That whole regulatory implication would help address the lack of clarity in the marketplace.

David: Were there any current topics that you expected to hear about, but didn’t?

Lois: I didn’t hear very much about decarbonization or climate change, which are enormous drivers in several markets we work in, especially California. They have legislated goals like doubling of energy efficiency, 100% renewables and scaling up electric vehicles, in reasonably short 10 to 15 year timeframes. I didn’t hear anything about that at DistribuTECH, where the driver remains the utility business model, which is largely the old school model with some very valiant efforts to start moving in a different direction.

Bryce: People were talking about those valiant efforts, about making the case for the core utility business future. But the business case rationale has not kept up with the pace of capabilities that technology now can offer. Time and again in the last handful of months, many sizable grid modernization requests are getting shot down. The industry is seeing that it needs to articulate more clearly the value that these advanced technologies are going to bring, and clearly lay out why customers should be footing the bill for these socialized investments. Otherwise, there remains a bit of friction amongst regulators and operators requesting these large infrastructure modernization expenditures.

Lois: I saw a fair amount of attention on customer side programs, on residential versus C&I. There seems to be a higher level of comfort and more maturity on some residential solutions.

Bryce: I’ve been actually surprised to see that the silos between commercial building facilities management and grid operators still remain intact. There’s not very much dialog there to mutually figure out solutions that are in the best of both worlds. I didn’t hear much about it at the show.

David: What was the general mood of those you talked to? What was the feeling of the attendees at DistribuTECH?

Bryce: Positive. People are seeing that progress is being made on a lot of fronts, around business models, market structure, culture, financing. Many of the demonstration scale deployments have technically been successful, and the technology risk has been significantly lowered, at least proven to be much less so an issue.

Lois: I agree that it was positive. Yet it seemed that some of the technology providers are worried. “Are we going to make it?” The field is growing. It’s getting more competitive. One vendor really struggled when I asked him to explain his company’s value proposition, and how they’re positioning themselves in the market. There is going to be a lot of clearing of the market as some of this moves forward. If you’re small, can you find your space? How do you compete?

Bryce: We can anticipate some settling of providers, because it’s unclear how some of these areas scale. As they scale, there may be more real activity by big industrial providers, or some of the growth stage providers may see consolidation. There’s quite a few growth stage companies that have some level of customer traction. So yeah, I wouldn’t be surprised if a number of them are worried. It’s not entirely clear who the leaders are. Also at some juncture, many of these companies will need to figure out how they scale with their customer base. I’ve been reasonably happy with the accessibility for capital in this industry. I’ve seen earlier stage companies that seemed promising, get the seed and A rounds that they need, and companies that seemed to have good traction get the follow-on rounds that they need. There’s still a lot of upside potential on where these technologies can head. That’s another reason for general optimism I’m seeing.

David: What was it like being part of the Northwest contingent in the Prosper Portland booth? Next year, we should be looking forward to doing it again?

Bryce: I want to sincerely thank the City of Portland, Prosper Portland, their partners, and other community development organizations for making this possible. Smart Grid Northwest as an organization has been to this event many times. This is the first time we’ve had a physical presence, and being there alongside our member companies worked out really well. Having a physical space lends you the opportunity to have drop-ins. Many people that either knew us, or just wanted to ask about what we’re up to, dropped in. And it was also a great place for grid operators to meet us. Many utilities came by, chatted with us, heard about what we’re doing.

Lois: I divided my time between the booth and the floor. In both cases, having a physical presence elevated the conversation. Whenever I talked with people, they would ask, “Oh, and so where’s your booth? Maybe we can stop by later.” Or, “I’ll send so and so by later.” I was able to say ” You can find me here along with LO3 and TripWire.”

The booth showed the diversity of what’s going on in the Northwest, particularly Portland. LO3 Energy, Tripwire and Smart Grid Northwest represent three important and innovative areas of grid management.” – Lois Gordon

Bryce: New Orleans was new geography for us, that was part of what drew me to wanting to commit to the event this year. When it’s in San Diego in 2020, we’ll see a lot more West coast involvement and we’ll be there, we are thinking about San Antonio next year.